Breaking Down the New Japanese Sustainability Reporting Standards

How the Nation is Aligning with Global Sustainability Commitments

In a significant move that aligns Japan with global sustainability efforts, the country recently implemented sustainability reporting standards modeled after the International Sustainability Standards Board (ISSB). On March 5, 2025, the Sustainability Standards Board of Japan (SSBJ) officially issued the first set of standards, aimed at enhancing transparency and accountability in corporate environmental, social, and governance (ESG) disclosures. This development is part of a broader international push to ensure companies report comprehensively and uniformly on their sustainability impacts.

Japan, already a leader in corporate sustainability practices, has long supported transparent reporting on ESG issues. According to KPMG’s 2022 research, 87% of Japan’s top 100 companies currently use the Global Reporting Initiative (GRI) standards, with 75% of these companies also undergoing external assurance on their sustainability reports1. This widespread independent adoption demonstrates a deep commitment to improving environmental performance and mitigating financial risks related to sustainability. As Japan seeks to further solidify its position as a leader in responsible business practices, the SSBJ’s new standards offer a clear path toward standardized and globally aligned best practices.

Background: The Evolution of Japan’s Sustainability Standards

The journey toward the creation of these new sustainability standards began with the establishment of the SSBJ in 20222. In March 2024, the SSBJ released three exposure drafts of the proposed standards, inviting feedback from various stakeholders across industries. The drafts included key proposals on the scope of reporting and the timing of disclosures, as well as adjustments to reporting metrics based on national needs.

However, during the feedback period, SSBJ recognized that some critical issues, such as the calculation periods for reporting key metrics, needed further clarification. To address this, the SSBJ issued a revised exposure draft on November 29, 2024, offering updated proposals for public comment. After another feedback period, during which 27 comment letters were received, the SSBJ approved the standards during its 49th board meeting on February 19, 2025. Less than two weeks later, the SSBJ released the final set of standards, marking a historic moment in Japan’s sustainability reporting framework.

What Are the SSBJ Standards?

The SSBJ standards represent a significant leap forward in Japan’s commitment to sustainability reporting. They are split into three standards:

Universal Sustainability Disclosure Standard (Application Standard) – This foundational standard sets the guidelines for the application of all sustainability disclosure requirements. It establishes the framework within which all other disclosures are made, ensuring consistency across reports.

Theme-based Sustainability Disclosure Standard No. 1: General Disclosures – This standard covers the basic information and disclosures that companies must report about their sustainability efforts. It includes the company’s governance structure, risk management processes, and overall strategy regarding sustainability, ensuring a holistic approach to ESG reporting.

Theme-based Sustainability Disclosure Standard No. 2: Climate-related Disclosures – This theme-specific standard is dedicated to climate-related risks and opportunities. It requires companies to report on their exposure to climate risks, including both transition risks (risks arising from the shift to a low-carbon economy) and physical risks (risks stemming from climate change impacts). This standard places a heavy emphasis on aligning with global initiatives to track climate-related financial disclosures, such as the Task Force on Climate-related Financial Disclosures (TCFD).

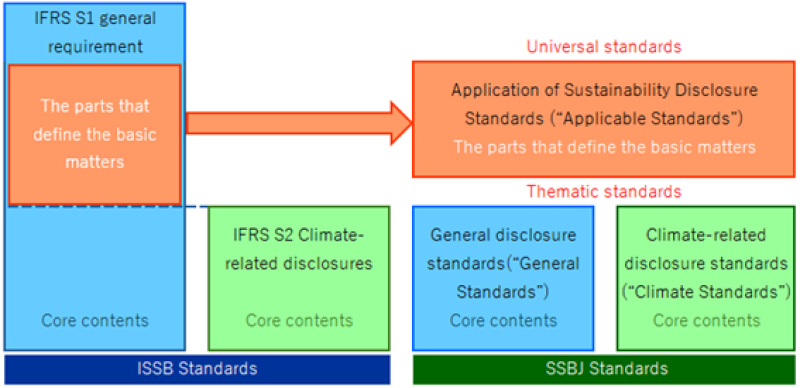

A defining feature of the SSBJ standards is their alignment with the ISSB Standards IFRS S1 and S2, which deal with general sustainability and climate-related disclosures. The SSBJ decided to integrate these standards to ensure Japanese companies adhere to international best practices while also allowing for jurisdiction-specific nuances. In other words, while the SSBJ standards broadly mirror the ISSB’s framework, they also provide flexibility for Japanese companies to incorporate local regulatory and reporting needs.

How Are the SSBJ Standards Different from Other Local Sustainability Reporting Standards?

Japan’s approach to sustainability reporting through the SSBJ standards stands out in several key areas, particularly in how it adapts global standards to local needs. One of the most notable differences is the way the SSBJ standards split the reporting requirements from the ISSB’s S1 into two separate standards. The first is focused on the application of sustainability standards and is designed to lay the groundwork for reporting practices. The second addresses the broader, general disclosures that companies must make regarding their governance and strategic approach to sustainability.

This separation of requirements offers greater clarity and flexibility for companies, as it helps to delineate the fundamental building blocks of sustainability disclosure from more detailed, specific requirements. Additionally, unlike many international frameworks, the SSBJ standards do not prescribe specific timelines for when entities must begin reporting under these guidelines. Instead, they are developed under the assumption that they will eventually be mandatory, with companies listed on the Tokyo Stock Exchange’s Prime Market likely to be among the first required to comply3. This means that while companies are encouraged to begin adopting the standards voluntarily, they must also prepare for future regulatory shifts that will require full compliance.

The Future of Sustainability Reporting in Japan

While the immediate impact of the SSBJ standards is likely to be felt most acutely by publicly listed companies, especially those in the Prime Market, the standards are expected to have far-reaching effects on Japan’s entire corporate ecosystem. The Japanese government is widely expected to mandate the use of these standards across a broader range of companies in the coming years. In fact, the expectation is that as global pressures for standardized ESG reporting continue to grow, Japan will be one of the first countries to integrate these standards into its corporate regulatory framework fully.

For companies operating in Japan, this means preparing for a future where sustainability disclosures are not just a matter of corporate social responsibility but a legally binding requirement. The global nature of the ISSB standards will also make it easier for companies to report their sustainability practices in line with other international standards, reducing the burden of producing multiple reports for different stakeholders.

A Step Toward a More Sustainable Future

Japan’s adoption of the SSBJ standards is a critical step toward creating a more transparent and sustainable global economy. By aligning with the ISSB framework and developing standards that account for Japan’s unique corporate environment, the country has reinforced its commitment to addressing climate-related risks and improving corporate governance. As these standards become mandatory in the future, Japanese companies will be better equipped to meet the growing demands for transparency and accountability in sustainability reporting. This move also sets a strong example for other nations considering similar initiatives, reinforcing the notion that sustainability reporting is not just a trend, it’s the future of business.

As businesses across Japan prepare to integrate these new standards into their reporting practices, they will not only be contributing to a more sustainable future but also gaining a competitive advantage in an increasingly ESG-conscious global marketplace.

This Week in Sustainability is a weekly email from Brightest (and friends) about sustainability and climate strategy. If you’ve enjoyed this piece, please consider forwarding it to a friend or teammate. If you’re reading it for the first time, we hope you enjoyed it enough to consider subscribing. If we can be helpful to you or your organization’s sustainability journey, please be in touch.