Highlights and Takeaways from the SEC's New Climate Disclosure Announcement

Climate compliance arrives in the US

This week, the SEC (Securities & Exchange Commission) unveiled a proposal for "The Enhancement and Standardization of Climate-Related Disclosures for Investors." It’s big news in ESG, indicating the US will follow EU and UK regulators by introducing mandatory corporate climate diclosure requirements.

For a more in-depth writeup on the SEC’s proposed legislation, have a look at our SEC climate disclosure primer. For this this week’s newsletter, we’re summarizing highlights and key takeaways here.

This is About Standards and Investor Transparency

The SEC makes it clear upfront its proposal is meant to solve two problems:

Inconsistent climate disclosure - Even among companies using the same reporting standard, there’s broad variability in terms of what companies actually report. The SEC wants more consistent standards in terms of what companies are reporting

Lack of transparency for investors - Investors want to understand companies’ climate risks and opportunities, but have difficulty (a) finding reliable information and (b) comparing companies’ climate and ESG performance

SEC Climate Disclosure Requirements

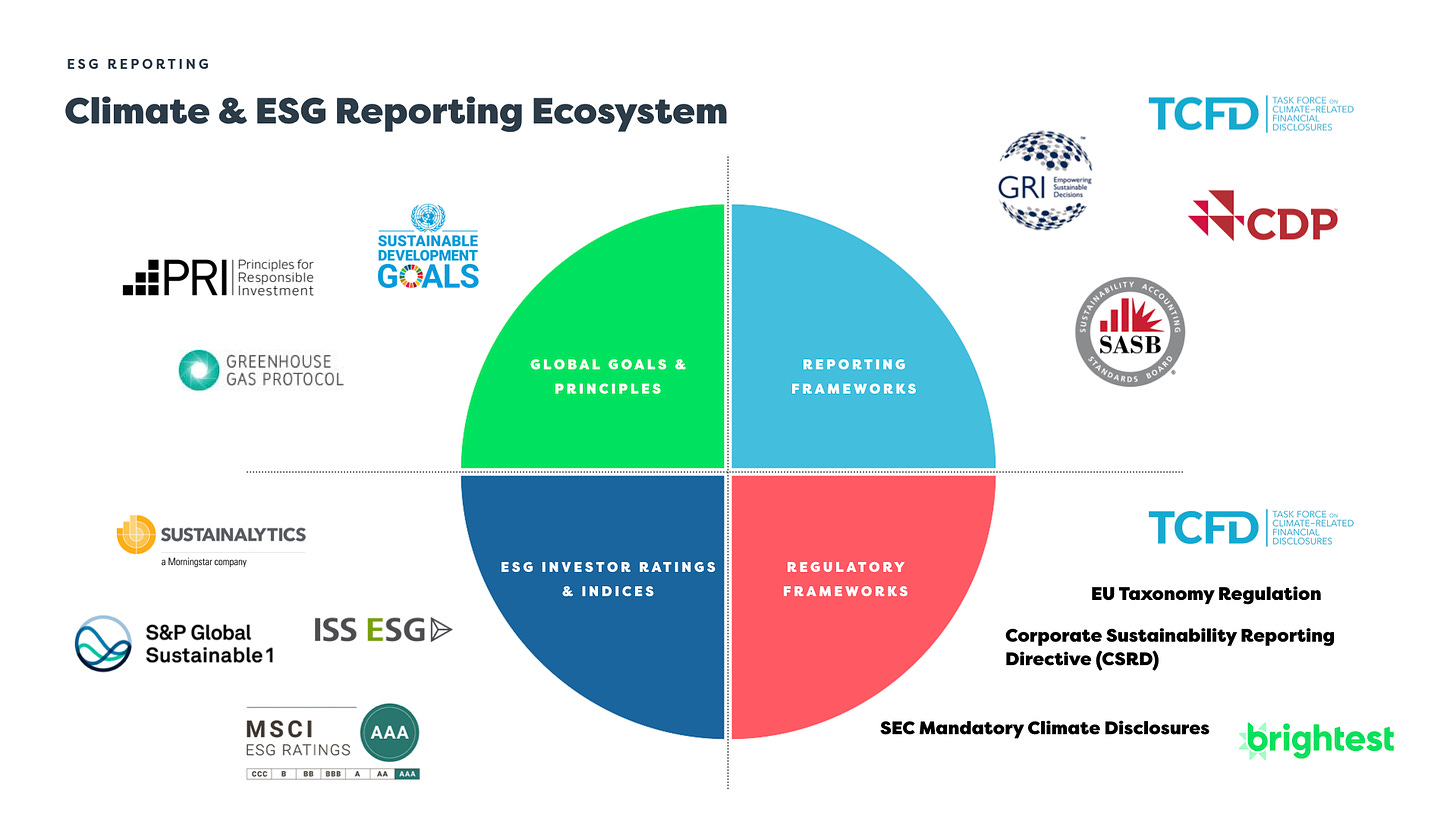

The SEC’s initial guidance is closely aligned with TCFD (Task Force on Climate-Related Financial Disclosures)’s recommended disclosure approach. This means organizations will effectively need to integrate climate risk and carbon accounting into their regular financial accounting and regulatory reporting cycles.

This includes reporting around four climate disclosure themes:

Governance - How a company’s board and management exercise their oversight and set climate-related targets and goals

Strategy - How sustainability and environmental risks (including climate change) impact the company’s operating performance, financials, business model, and shareholder value

Risk Management - How climate-related risks are identified, assessed, and managed

Metrics and Targets - An organization’s operational plan for climate-related risks, opportunities, and investments, including:

Specific sustainability and climate performance targets, goals, scenarios, and progress-to-goal

Scope 1-2-3 greenhouse gas (GHG) emissions disclosure*

Relevant information on an organization's use of carbon offsets, credits, and/or renewable energy credits or certificates (RECs) as part of the company's overall net emissions reduction strategy

If your organization isn’t already familiar with TCFD and its reporting guidance, we suggest getting up to speed and comparing it with the SEC’s draft language.

Keep in mind TCFD provides guidance on disclosure topics, but not actual climate metrics. Be sure to reference metric-based sustainability standards like Greenhouse Gas Protocol (which the SEC also highlights), as well as the science-based targets (SBT) methodology when you’re setting operational targets and KPIs.

Who’s Impacted When

The SEC's climate rules are currently in proposal form and haven’t been passed into law yet. Updates to the Securites Act and the Exchange Act are expected to happen later in 2022, although it's possible we don’t see final SEC guidance until early 2023.

Right now, the timeline for SEC Mandatory Climate Disclosures coming into effect is:

March - May 2022 - Interested participants are asked to submit public comments

May - September 2022 - SEC will review public comments and draft the final laws and regulations

October - December 2022 - We expect formal legal SEC guidance enacted and communicated during this time

2023 - SEC climate disclosure requirements take effect and large accelerated filer organizations will need to track their 2023 ESG strategy, risks, and performance to prepare their SEC reporting. This includes all proposed SEC climate disclosures, including GHG metrics and Scope 1 and 2 emissions, but excludes Scope 3 emissions (until 2024 fiscal year). See here for the latest SEC filer definitions.

2024 - Qualifying businesses will need to disclose SEC reporting according to a first set of climate disclosure standards for their 2023 financial year. Accelerated filer and non-accelerated filers will also be required to begin disclosing their required GHG metrics and Scope 1 and 2 emissions for this current fiscal year in the following reporting year. Large accelerated filers will now be required to start disclosing Scope 3 emissions.

Or, to summarize:

Full Value Chain Carbon Accounting is Here

As the SEC proposal outlines, large corporations will need to start reporting Scope 1 and Scope 2 GHG in fiscal year 2023 with limited assurance, then transition to reporting full Scope 1-2-3 emissions from 2024 onward with reasonable assurance thereafter. “Assurance” means the company’s carbon accounting is reviewed by a neutral, trusted, and experienced third party providing an attestation report.

We see this as "limited" assurance of the ESG information being disclosed, which is less strict than a financial audit, but still requires working with a sustainability reporting partner organization to review the work.

For smaller organizations, similar emissions reporting requirements kick in between 2024 and 2026, but smaller reporting companies** will not be required to track and disclose Scope 3 emissions.

What’s Next

We don’t know what the SEC’s final rules will look like, but this draft proposal gives us fairly high confidence where they’re going to end up. Mandatory corporate climate disclosures for publicly-traded companies are inevitable, and impacted companies should take care to implement their SEC climate disclosure compliance approach by 2023 to be ready for the 2024 reporting cycle.

On our end, we’ve been reviewing Brightest’s ESG and GHG reporting product to make sure our roadmap, methodology, and carbon accounting standards align with SEC (and EU CSRD) requirements, including audit logs, attestations, and policy management tools. Feel free to send us a message if you’d like to learn more or discuss your organization’s gaps or needs.

—

This Week in Sustainability is a weekly(ish) email from Brightest (and friends) about sustainability and climate strategy. If you’ve enjoyed this piece, please consider forwarding it to a friend or teammate. If you’re reading for the first time, we hope you enjoyed it enough to consider subscribing. If we can be helpful to you or your organization’s sustainability, ESG, or social impact journey, please be in touch.

*Excluding small companies as defined by the SEC

** The SEC’s rules define a smaller reporting company to mean an issuer that is not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent that is not a smaller reporting company and that: (1) had a public float of less than $250 million; or (2) had annual revenues of less than $100 million and either: (i) no public float; or (ii) a public float of less than $700 million