Double Materiality Assessment Explained

Understanding what a double materiality assessment is and how to perform it

With the Corporate Sustainability Reporting Directive (CSRD) making double materiality assessments mandatory, this topic has surged to the forefront of sustainability discussions. Although crucial, the mechanics and implications of double materiality can be intricate and challenging to grasp. This article will explain what a double materiality assessment is and the steps to perform it.

Understanding Double Materiality

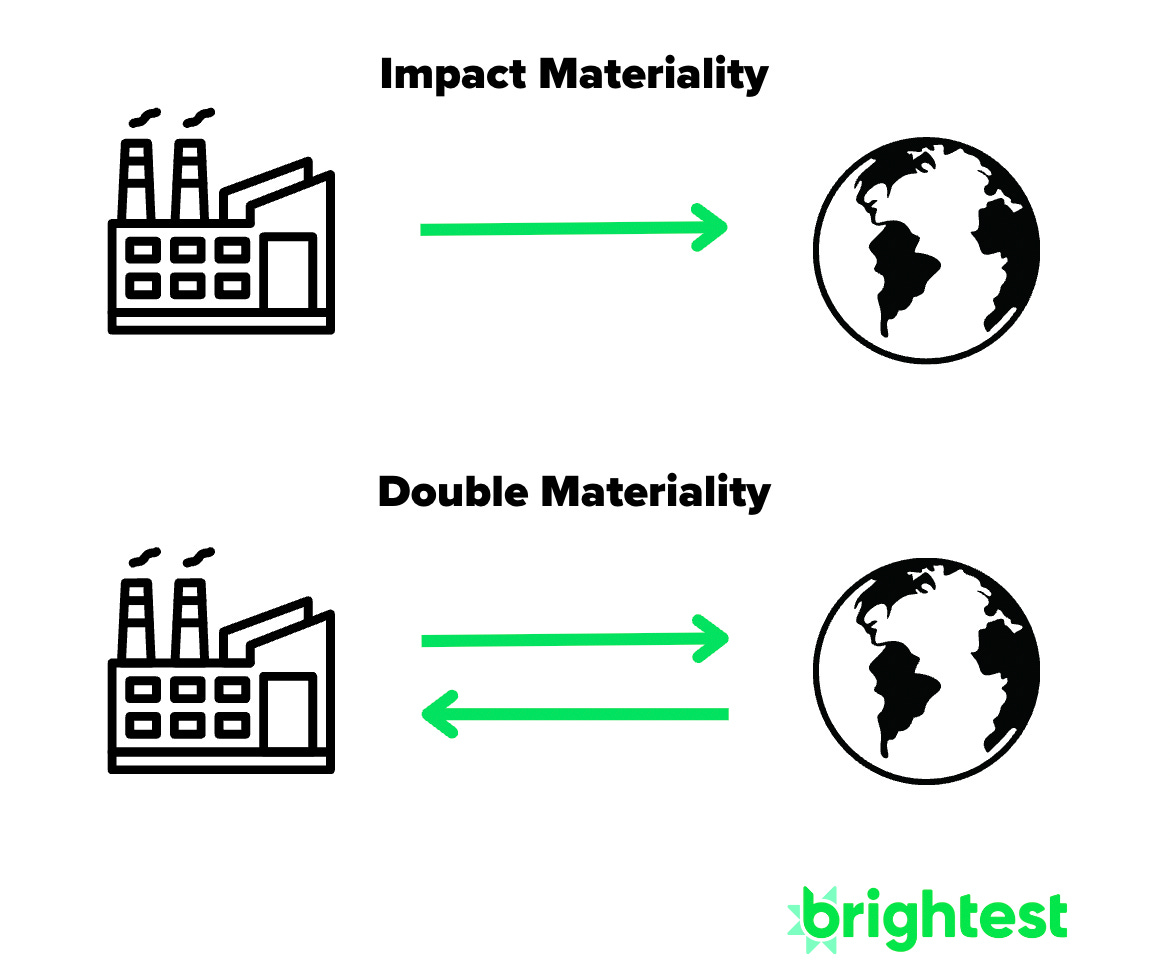

Double materiality splits the materiality concept into two distinct types: financial materiality and impact materiality. Financial materiality concerns how environmental, social, and governance (ESG) factors influence a company's financial health and performance. Conversely, impact materiality focuses on how a company's actions affect a company’s stakeholders and the environment. Double materiality is used to determine the significants of ESG impacts, risks, and opportunities on both financial and impactful basis. This dual perspective ensures that a company's sustainability efforts contribute effectively to the triple bottom line (People, Planet, Profit).

As shown on the matrix, 5 topics have been selected as material (or you could also say as “relevant”): climate change mitigation, employee engagement, corruption & bribery, climate-related physical risk, and regulatory compliance. Each topic must be rated on a scale from 1 (low importance) to 10 (high importance). This example shows that the most relevant topic, from a financial and impact standpoint, is regulatory compliance which scores 10 on both criteria.

How to Conduct a Double Materiality Assessment?

When conducting a double materiality assessment, organizations must review their own operations and their upstream and downstream value chain which can be complicated. To conduct a double materiality assessment effectively, we recommend following this step-by-step approach:

Define Objectives and Scope: Clearly define the goals of the assessment and establish the scope. This includes determining the time frame, geographic regions, and business units involved. Because a double materiality assessment requires the support of many different people and groups, it is recommended to allow for extra time to complete it.

Identify Relevant ESG Issues: Compile a comprehensive list of environmental, social, and governance (ESG) issues that could potentially impact the business financially and/or affect society and environment. When performing a double materiality assessment for CSRD reporting, it is important to use the topics created by the ESRS (European Sustainability Reporting Standards). Below is a diagram of some of the topics, sub-topics, and sub-sub-topics that an organization will need to consider before starting its double materiality assessment.

Engage Stakeholders: Create a survey to send to internal and external stakeholders like employees, board members, investors, customers, and suppliers. This survey should help organizations to determine their most significant impacts on climate and society and their relevant sustainability risks and opportunities. If feasible, organizations can conduct interviews with their key stakeholders for a more nuanced understanding of relevant ESG topics.

Prioritize Material Issues: Once answers from stakeholders have been compiled and reviewed, responses should help determine what ESG topics are most material and need to be reported on.

Create a matrix: Organizations can use materiality matrix to conceptualize and visualize the most salient topics. Here is an another example of a double materiality matrix.

Define and Assess: From here, organizations can define the material ESG impacts, risks, and opportunities and begin to assess them. Defining the materiality topics based on their impacts on the organization and associated risks and opportunities can be a tricky process because these topics are interconnected and can range over different time horizons. Once defined, teams can go into quantify and assess these impacts, risks, and opportunities.

Document and Report: Prepare a detailed report documenting the methodology, findings, and outcomes of the double materiality assessment. This should include how identified material issues are expected to impact the business and stakeholders, and any planned responses or strategies to address any issues.

Review and Update Regularly: Since market conditions, regulatory environments, geopolitics, macro trends, and stakeholder expectations change, regularly review and update the materiality assessment. This ensures that the company remains aligned with current realities and continues to focus on the most impactful issues on its finances and on society.

Why is this relevant?

Double materiality assessments are critically important right now because they are a core aspect of CSRD and its main concepts are integrated into the EU’s Sustainable Financial Disclosure Regulation (SFDR). CSRD will require over 50,000 companies around the world to complete double materiality assessments and SFRD will require many financial institutions and companies linked to them to assess sustainability related impacts internally and externally.

Voluntary frameworks like the Global Reporting Initiative (GRI) and the Climate Disclosure Standards Board (CDSB) also ask companies to report on both the financial implications of sustainability issues and their broader impact on environment and society.

Challenges and Considerations

Double materiality assessments are really valuable tools for understanding ESG impacts on companies and society, but they can also be quite a large undertaking with some potential challenges and considerations.

Stakeholder Engagement: Effectively identifying a diverse range of stakeholders to understand their sustainability concerns is crucial. A diverse set of stakeholders will inform companies’ ESG topics in a more meaningful way. Engaging with these stakeholders to get feedback is also key, but it can be time-consuming and tiring to press stakeholders for their responses.

Data Availability and Quantification: Accurately assessing the impact companies have on environmental and social factors can be difficult especially if it is their first time completing a materiality assessment. Collecting qualitative and quantitive data on material ESG topics and their impacts, risks, and opportunities will require the collaboration of many different internal and often external partners.

Time and Effort: Completing double materiality assessments can be resource-intensive. Gathering data, engaging stakeholders, and creating a comprehensive report all take considerable time and effort.

Dynamic Reporting: A successful double materiality assessment is not something that is completed once and then not touched for a few years. These assessments should be reviewed and updated frequently with changes in business operations and global macro events. Our double materiality tool enables to update all data in real time to have the most accurate matrix at all times.

Conclusion

In conclusion, double materiality assessments are rapidly evolving from a less common concept to a mandatory practice under the CSRD. This shift presents a significant opportunity for companies to not only comply with regulations but also gain a deeper understanding of their sustainability impacts. While challenges like stakeholder engagement and data availability exist, the benefit of many organizations completing double materiality assessments is meaningful for sustainability progress.

This Week in Sustainability is a weekly email from Brightest, a leading ESG data management provider & strategic advisory services team. If you’ve enjoyed this piece, please consider forwarding it to a friend or teammate. If you’re reading it for the first time, we hope you enjoyed it enough to consider subscribing. If we can be helpful to you or your organization’s sustainability journey, please be in touch.