In conversations, we sometimes hear ESG (environmental social governance) and sustainability used interchangeably. Since the “E” in ESG stands for “environmental,” it’s common to think sustainability is simply one pillar or sub-component of overall ESG. In some sense this is true, but there are important differences between ESG and sustainability that have implications for corporate strategy, communication, prioritization, and reporting.

Let’s quickly break those differences down.

What is ESG?

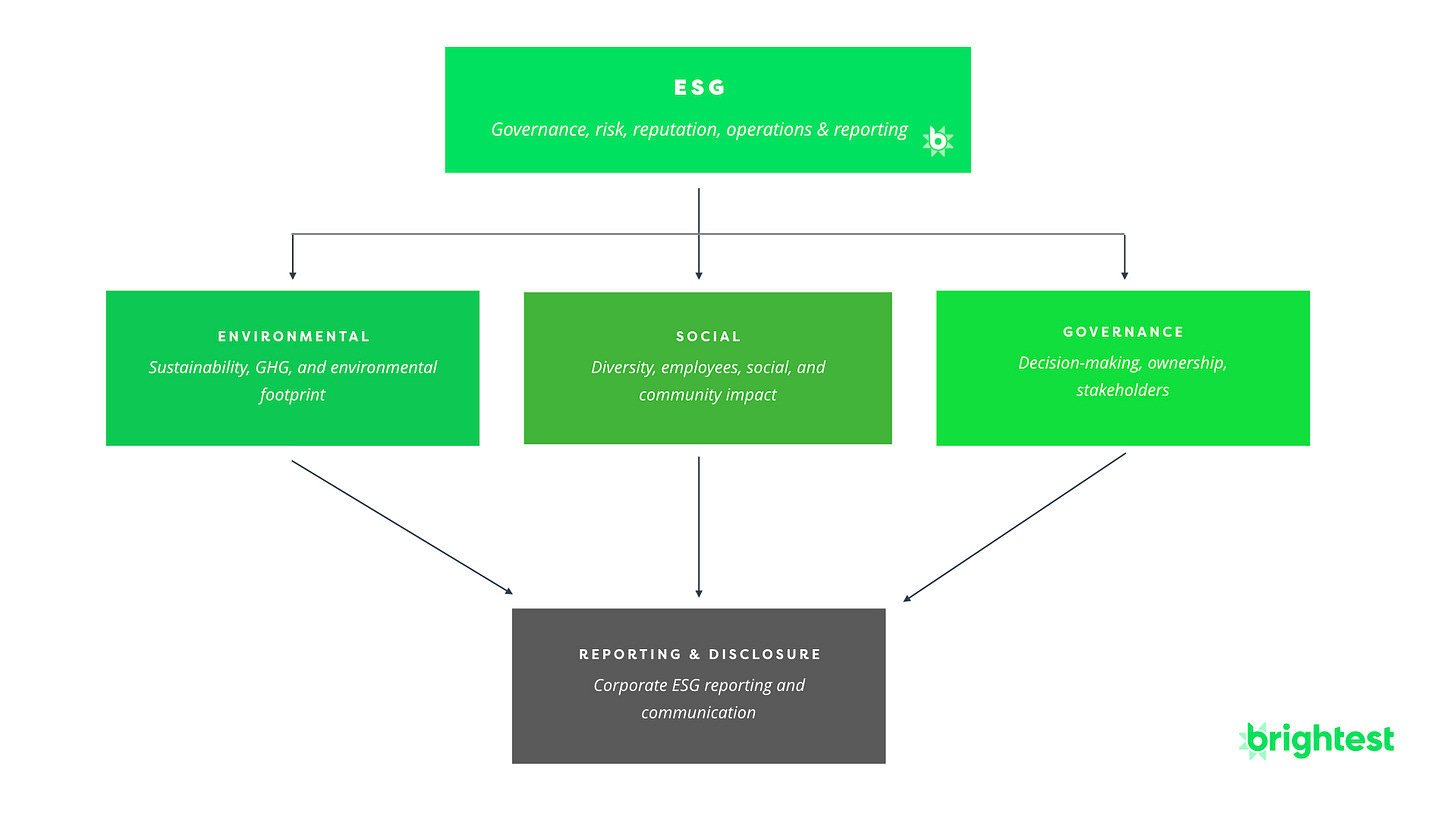

ESG, at it’s core, is a corporate governance and investment framework. What this means in practice is companies that adopt ESG principles consider, measure, report (and, hopefully, work to improve) the environmental, social, and governance aspects of their business alongside its financial considerations (profit, expenses, growth, accounting). Likewise, ESG investors consider a company’s environmental, social and governance attributes alongside their financial attributes when deciding whether or not (and how) to invest in them.

When you think ESG, think capital, operations, risk, reputation, and reporting (or “CORRR” if you like acronyms), which includes several things that go beyond environmental sustainability. This includes:

Environmental activities, attributes, and disclosures: our greenhouse gas emissions, carbon accounting, waste management, and other environmental impacts. This ESG category essentially encompasses our definition of corporate sustainability — balancing the environment, equity, and economy across products, packaging, facilities, energy usage, people, and waste in a way that doesn’t contribute to global warming, climate change, and biodiversity loss — through an investment and corporate decision-making lens.

Social activities, attributes, and disclosures: our human rights, labor standards, workplace health and safety, employee diversity and inclusion, and other social and community impacts.

Governance activities, attributes, and disclosures: our ownership structure, decision-making process, corporate policies, and other aspects that balance the rights, responsibilities, and identity of various shareholders and stakeholders in the company.

A second way is to view corporate ESG as the social or externality side of financial accounting. In modern history, public companies operate, perform financial accounting, and then issue shareholder reports like a 10-K which investors can use to decide if they want to invest in the company or not (i.e., understand if the company’s operating well and creating shareholder value). The problem with this narrow approach however — as we recently saw with Exxon Mobil — is that financial accounting alone doesn’t fully account for the consequences and risks of operating a company, particularly short-term.

Global ESG investment is growing rapidly, with hundreds of billions of dollars flowing into ESG in 2020 and 2021. Source: Morningstar

If a company makes a profit manufacturing toxic poison then dumps everything it can’t sell into the local river next to its factory, it could have good financial accounting performance on paper. But anyone who uses an ESG framework or lens to view the company quickly realizes (a) the company’s not counting the real costs of its business and (b) there are huge risks to its business viability, such as the government noticing what it’s doing and shutting it down.

No ESG investor would invest in this company. And that in and of itself is increasingly becoming a risk to companies: as trillions of investment dollars transition to ESG, many environmentally or socially harmful companies are seeing it become more and more difficult to find investors who will fund their business.

The Difference Between ESG and Sustainability

Now that we’ve defined ESG, let’s summarize the key differences between ESG and sustainability:

ESG is about company stakeholders, identity, and decision-making — the board, CEO, employees, shareholders, and other stakeholders — whereas sustainability is about the relationship between a company and the environment

ESG is an investment framework that helps external investors assess company performance and risk, whereas sustainability is a framework to make internal capital investments (i.e., installing LED light bulbs or other energy efficiency measures, electrifying a transportation fleet, purchasing sustainability measurement software)

ESG is based on standards set by investment and reporting organizations (e.g., PRI, TCFD, MSCI), whereas sustainability standards — while also set by standards groups like GHG Protocol — are more science-based and standardized

ESG includes sustainability as one of its three pillars, but also incorporate broader social and corporate governance considerations

ESG is typically more relevant for large companies who are listed on public investment exchanges or who need get financing from institutional investors. However, as more banks and financial services firms themselves adopt ESG principles around their business, ESG is also increasingly becoming more material to startups and smaller organizations

This overall risk and materiality profile of ESG is a key place where it differs (and goes beyond) sustainability. For example, a company could have a completely carbon-neutral, zero-waste, renewable-powered manufacturing facility, but if that facility is wildly dangerous to work in from a workplace health and safety standpoint (i.e., employees are getting injured on the job all the time), the company still isn’t meeting its ESG obligations despite, again, achieving environmental sustainability on paper.

To recap, ESG and sustainability are both important, strategic considerations for modern companies and executive teams. And while they do have some overlap, there are also important fundamental distinctions around how a company approaches, prioritizes, and measures their ESG performance alongside their sustainability programs and initiatives.

—

This Week in Sustainability is a weekly email from Brightest (and friends) about sustainability and climate strategy. If you’ve enjoyed this piece, please consider forwarding it to a friend or teammate. If you’re reading it for the first time, we hope you enjoyed it enough to consider subscribing. This piece was originally posted on Brightest. If we can be helpful to you or your organization’s sustainability journey, please be in touch.