Australia's New Sustainability Reporting Standards Explained

Navigating the New Australian Sustainability Reporting Standards: Key Requirements and Timelines

2025 has already been a big year for sustainability. Among the many other significant developments, the implementation of several new sustainability reporting directives stands out.

Along with other regions, Australia has introduced a new set of sustainability reporting requirements. These guidelines, aligned with the International Sustainability Standards Board (ISSB) standards, are designed to enhance the transparency and credibility of sustainability reporting. By adopting these reporting frameworks, Australian businesses will not only meet local regulatory requirements but also ensure their alignment with global sustainability standards.

As companies across the world adapt to these new reporting obligations, it is important to understand what the Australian Sustainability Reporting Standards (ASRS) entail, who needs to comply, and how companies can prepare to meet these new requirements.

What are the Australian Sustainability Reporting Standards (ASRS)?

The Australian Sustainability Reporting Standards (ASRS) were introduced under the Corporations Act 2001, effective January 1, 2025. These standards represent a significant shift in how companies are expected to report on their sustainability impacts, particularly in terms of climate-related financial information. ASRS aligns with the ISSB’s International Sustainability Standards, which were developed to provide consistent, comparable, and reliable sustainability disclosures on a global scale.

“The Standards provide clear guidelines that require businesses to measure and report on their environmental impact with greater rigor. This will lead to more accurate data collection and better-informed decision-making, ultimately supporting a more integrated approach to sustainability.” - Ryan McKenzie, Director of Volta Energy Group

The ASRS specifically mandates comprehensive reporting on climate-related risks and opportunities, as well as Greenhouse Gas (GHG) emissions. These new requirements are designed to ensure that businesses are transparent about how climate change affects their operations, their approach to mitigating climate risks, and their strategies for seizing climate-related opportunities. In turn, this will increase transparency and allow investors, regulators, and other stakeholders to make better-informed decisions.

The ASRS consists of two main standards:

AASB S1: General Sustainability Reporting Requirements

AASB S1 outlines general sustainability reporting guidelines, providing a framework for companies to disclose their sustainability practices. At this stage, reporting under AASB S1 is voluntary for sustainability matters other than climate-related disclosures. However, companies are encouraged to report on areas such as environmental, social, and governance (ESG) factors, which could include topics like water usage, waste management, and human rights impacts.AASB S2: Climate-Related Disclosures

AASB S2 mandates that companies disclose climate-related financial information, aligning closely with the ISSB’s IFRS S1 and S2 standards. This mandatory reporting covers key areas like climate risks, the financial impact of climate-related events, transition risks associated with moving toward a low-carbon economy, and GHG emissions. Companies will need to provide specific, detailed disclosures on their emissions profiles, climate governance, and risk management strategies.

These two standards form the backbone of the ASRS, ensuring that climate-related disclosures are made consistent with international best practices while also providing flexibility for other sustainability reporting on a voluntary basis.

“The new regulations are expected to drive greater transparency in reporting and encourage businesses to integrate sustainability further into their operations. There may be initial compliance costs, but over time, businesses should benefit from improved environmental performance and stakeholder confidence.”- Ryan McKenzie, Director of Volta Energy Group

Who Is Required to Report and When?

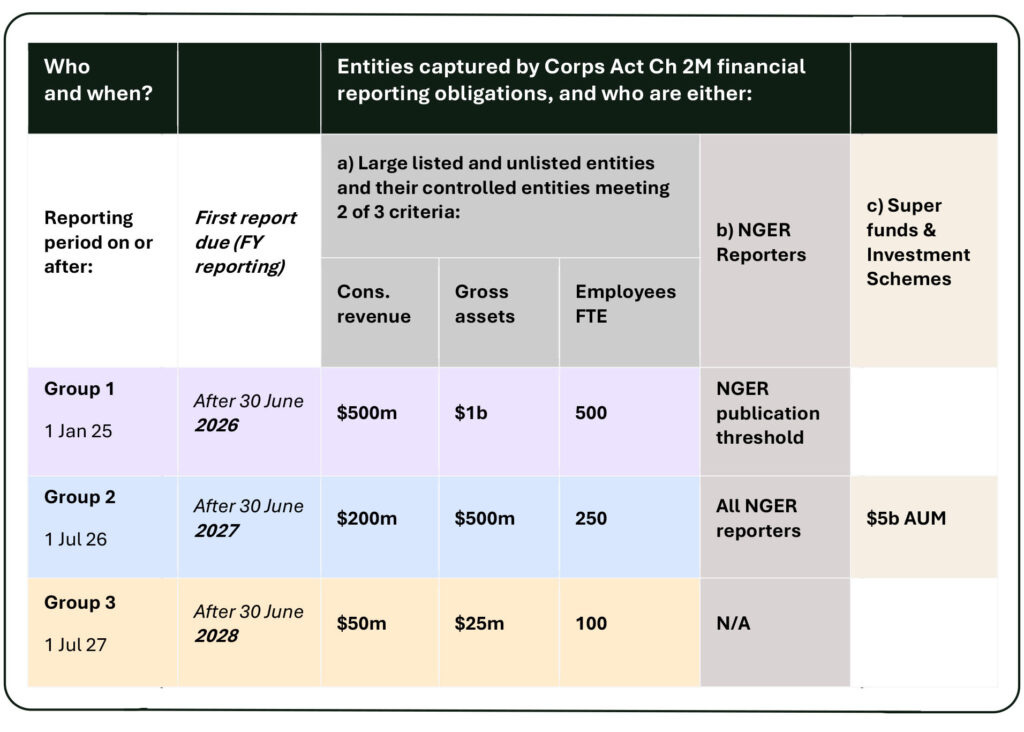

The new Australian Sustainability Reporting Standards (ASRS) introduce phased reporting requirements for companies, based on their size and financial activity. The criteria for who must report are determined by meeting two of the three specified reporting thresholds, which are based on consolidated gross revenue, consolidated assets, and the number of employees. These requirements will be implemented in stages, with different groups of companies required to report at different times.

Group 1: First Annual Reporting Periods Beginning On or After 1 January 2025

For companies with significant financial activity, reporting under ASRS will be mandatory starting on 1 January 2025. To fall into Group 1, companies must meet at least two of the following three thresholds:

$500 million or more in consolidated gross revenue

$1 billion or more in consolidated assets

More than 500 employees

Additionally, companies that report under the National Greenhouse and Energy Reporting (NGER) scheme and meet the NGER publication threshold will also be required to comply with the ASRS. However, asset owners are scoped out of Group 1.

Group 2: First Annual Reporting Periods Beginning on or After 1 July 2026

Starting on 1 July 2026, Group 2 companies will need to comply with ASRS reporting requirements. To be included in this group, companies must meet at least two of the following three thresholds:

$200 million or more in consolidated gross revenue

$500 million or more in consolidated assets

More than 250 employees

This group also includes companies that are NGER reporters but do not meet the thresholds for Group 1. Additionally, asset owners with $5 billion or more in assets under management will be required to report under the ASRS.

Group 3: First Annual Reporting Periods Beginning on or After 1 July 2027

Group 3 companies will be required to comply with the ASRS starting 1 July 2027. To be included in this group, companies must meet at least two of the following three thresholds:

$50 million or more in consolidated gross revenue

$25 million or more in consolidated assets

This final phase of implementation will apply to smaller companies, ensuring that sustainability reporting eventually extends across a broader range of businesses.

How to Report and What Must Be Included?

Preparing for the ASRS and ensuring compliance with both mandatory and voluntary requirements involves several steps. Companies will need to develop systems for measuring, collecting, and verifying the necessary data, which could be complex, depending on the size of the business and the scope of its operations. Below are some key elements that companies must include in their ASRS disclosures:

Climate Governance and Risk Management

Companies will need to provide details about how climate-related risks are governed within the organization, including the role of boards, executives, and relevant departments in overseeing climate-related issues. Disclosures should also include information on the organization’s strategy to manage physical and transition risks related to climate change.Climate Risks and Opportunities

Companies must report on the potential impacts of climate change on their operations, both in the short and long term. This includes identifying physical risks (such as extreme weather events or changing resource availability) and transition risks (such as regulatory changes or shifts in market demand). Additionally, companies must disclose climate-related opportunities, such as those arising from innovation, green technologies, or market leadership in sustainability practices.Greenhouse Gas (GHG) Emissions

One of the core elements of the ASRS is the mandatory disclosure of GHG emissions. Companies will need to report on their direct emissions (Scope 1), emissions from purchased electricity (Scope 2), and indirect emissions from their value chain (Scope 3). This is a key part of aligning with international climate goals and achieving transparency in the company’s environmental impact.Forward-Looking Information and Metrics

Companies will also need to provide forward-looking information on how they plan to reduce their GHG emissions and address climate-related risks. This could include setting emission reduction targets, implementing climate mitigation strategies, and aligning with the goals of the Paris Agreement.

Preparing for the ASRS: Steps to Take

Given the complexity of the ASRS requirements, it is essential for companies to begin preparing well in advance. While the mandatory climate-related disclosures won’t be due until the end of 2025, there are several preparatory actions that businesses can take now to ensure they are ready.

“Organizations can begin by reviewing their current reporting processes and data systems, investing in staff training, and updating internal policies. Strengthening data collection methods and consulting with sustainability experts will also help ensure a smoother transition.” - Ryan McKenzie, Director of Volta Energy Group

A few notable steps organizations can take to ensure they are ready for compliance are:

Establish Internal Reporting Processes

Companies should begin by setting up robust processes for collecting and reporting sustainability data, particularly around climate-related information. This may include investing in new technology, enhancing data management capabilities, or engaging third-party experts to ensure accurate and reliable disclosures.Engage Stakeholders

Transparency in sustainability reporting requires the involvement of multiple stakeholders within the organization, including executives, board members, sustainability teams, and finance professionals. Engaging these stakeholders early on will ensure alignment across departments and help streamline the reporting process.Review Current Reporting Practices

Companies that are already reporting on sustainability may need to review and refine their existing practices to ensure they meet the ASRS requirements. This might involve improving the granularity of data or aligning reports more closely with the climate-related disclosures outlined in AASB S2.

Proactive preparation is essential to ensure smooth and timely reporting, allowing businesses to meet ASRS requirements with confidence and avoid last-minute complications. By taking these initial steps now, companies can position themselves for success and demonstrate their commitment to transparency and sustainability well ahead of the 2025 deadline.

The Road Ahead

The Australian Sustainability Reporting Standards represent a crucial step toward improving environmental governance, increasing transparency, and supporting the global shift toward sustainable practices. By aligning with the ISSB standards, Australia is positioning itself as a leader in the global sustainability movement.

As companies work toward compliance with the ASRS, they not only meet regulatory requirements but also demonstrate a commitment to environmental stewardship and long-term value creation. Businesses that embrace these standards will be better positioned to manage risks, capitalize on new opportunities, and contribute to a more sustainable future.

By taking proactive steps now, Australian companies can ensure they are prepared for the evolving landscape of sustainability reporting and enhance their reputation in the eyes of investors, consumers, and regulators alike.

Brightest is excited to partner with Australian advisory and delivery firm Volta to assist Australian organizations in adhering to these new regulations

This Week in Sustainability is a weekly email from Brightest (and friends) about sustainability and climate strategy. If you’ve enjoyed this piece, please consider forwarding it to a friend or teammate. If you’re reading it for the first time, we hope you enjoyed it enough to consider subscribing. If we can be helpful to you or your organization’s sustainability journey, please be in touch.

Sources: